![(«H³ø°]¸g·s»D¥¼Àò±oµo§G¦¹·Ó¤ùªº±ÂÅv¡C¦p¦b«H³ø¥ô¦ó´CÅé¤Wµo§G¡A¦³¥i¯àIJ¥Ç«IÅvªk¨Ò¡C HKEJ has not been authorized to publish this image. Appearance of this image on any HKEJ distribution channels may cause legal issues.)¿ÂÃƪ÷ªA ¤á¥~¼s§i 2016.04.26(Source Unknown)](http://www.innovationkm.com/wp-content/uploads/2018/05/0202_P07.jpg)

A slate of hot Chinese technology companies are expected to debut in Hong Kong this year, including Ant Financial, the biggest highest-valued unicorn firm in the world.

Recently, the Ant Financial has finalized the last round of private funding before its initial public offering. The plan of its initial public offering is about to launch in both Hong Kong and Chinese mainland A-share markets in one or two years, with a valuation of $150 billion.

An ever-hottest last round of financing

Before the IPO, Ant Financial finalizes last round of financing. Famous institutes are beating down the doors of Ant, some of whom even offer term sheet without making due diligence. Singapore sovereign wealth fund GIC plans to inject the largest capital into Ant, and other lead investors include US private equity firm Warburg Pincus, Canada Pension Plan Investment Board, and Singaporean state investment firm Temasek Holdings.

At the same time, institutional investors such as Carlyle, General Atlantic, Silver Lake, Sequoia Capital China, BlackRock also participated in the financing, but no investor received a seat in Ant’s board of directors.

Ant Financial becomes the biggest unicorn in the world.

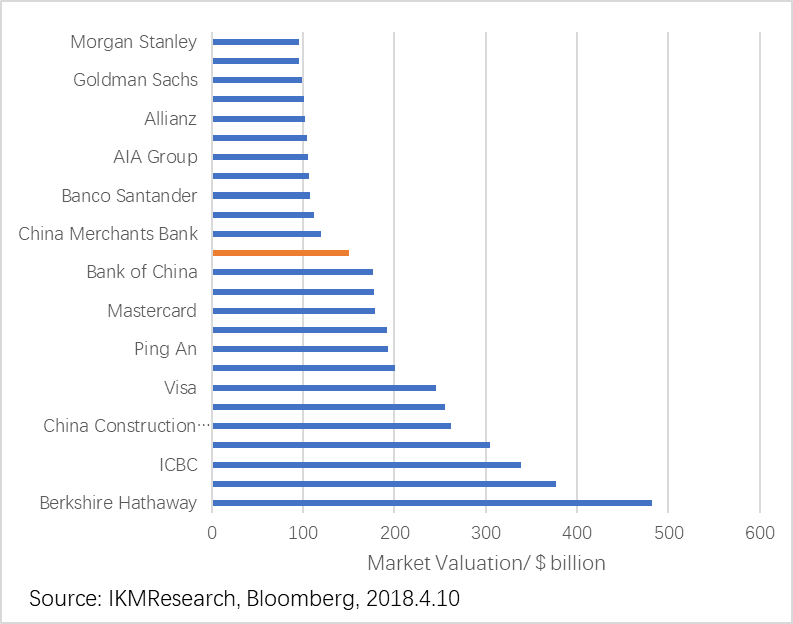

In the first quarter, the company became China’s highest-valued unicorn firm, with a valuation of more than 400 billion yuan, as the Q1 Hurun Greater China Unicorn Index showed. And the reported $150 billion valuation would make Ant the most valuable unlisted tech company in the world, ahead of Uber. Besides, the valuation of $150 billion will put it above U.S.-based financial services companies like Goldman Sachs or PayPal.

At a $150 billion valuation, the operator of Alipay and a money-market fund would rank 14th among financial-service firms.

The Fintech empire of Ant Financial is expanding.

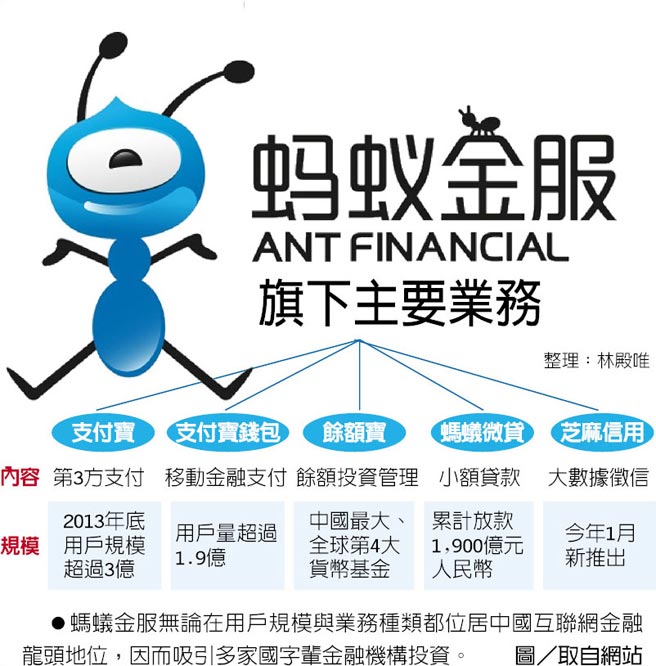

The fintech empire that the company established spanned verticals such as mobile and online payment (Alipay), money market fund (Yu’e Bao), wealth management (Ant Fortune), digital-only banking (MYbank), credit scoring (Zhima Credit), and consumer credit portal (Ant Credit Pay) among others. The total users is claimed to be 622 million and the worth of assets is to be $345 billion.

Ant’s lending practices have helped fuel consumption on Alibaba’s online shopping platforms, with any slowdown in loan growth likely to hit the ability of users to buy everything from iPhones to hairdryers.

Ant Financial Consumer Lending Reaches $95 Billion. Controlled by Alibaba Chairman Jack Ma, Ant has become a financial giant that was said to be valued at $60 billion and currently has more outstanding consumer loans than China’s second-biggest bank.

China tightens regulation over mobile payment apps in these days.

China is quickly hurtling towards a cashless society, Ant Financial is grabbing this unique opportunity to make a fast growth. However, China tightens regulation over mobile payment apps in these days. The central bank, the People’s Bank of China, raised on Dec. 30th the payment platforms’ reserve funds ratio from 20% to 50%, effectively putting more customer e-wallet deposits or funds held in escrow by payment providers under its own centralized management.

Ant Financial is trying to overcome and placing new business to maintain the companies’ revenue streams.

Firstly, it is aimed at the technology innovation. Ant Financial has processed the most of the blockchain patents in the world to reduce the financial risk.

Secondly, it also takes an opening mind to face the regulation and cooperates with the local regulatory authority. It has become one of the 5 pilot financial institutions subject to new rules drafted by Chinese financial regulators on financial holding companies.