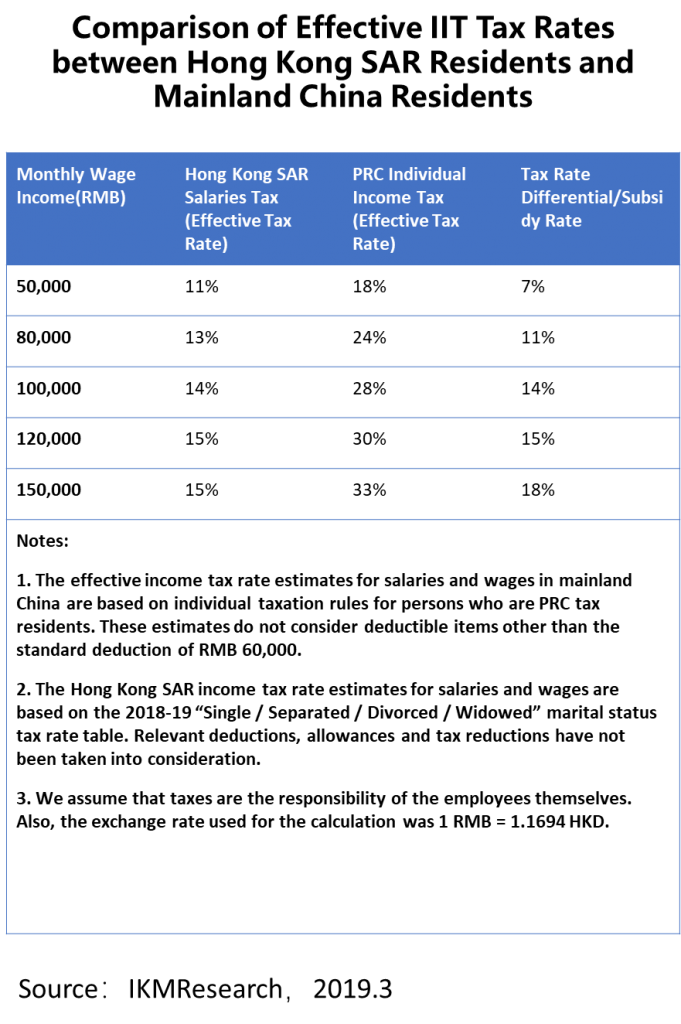

ShenZhen, the hometown of Huawei announces it will lower the salary tax to 15% from the current 45% in an effort to spur innovation, while the trade war continues to heat up between United States and China.

Wang Lixin, a deputy said the city will use its own operating income to make up for the shortfall in tax revenue. Under the scheme, qualifying individuals will be able to enjoy a significantly lower personal income tax.

Under the preferential policy, the individual incomes of overseas high-level science and technology talents will be taxed at 15 percent. For instance, talents with an annual salary of 1 million yuan (US$144,933) will only need to pay 150,000 yuan in income taxes, while under the preferential policy the total tax will come to nearly 260,000. A reduction of total tax will be more than 110,000 yuan compared with the sum taxed at the original rate.

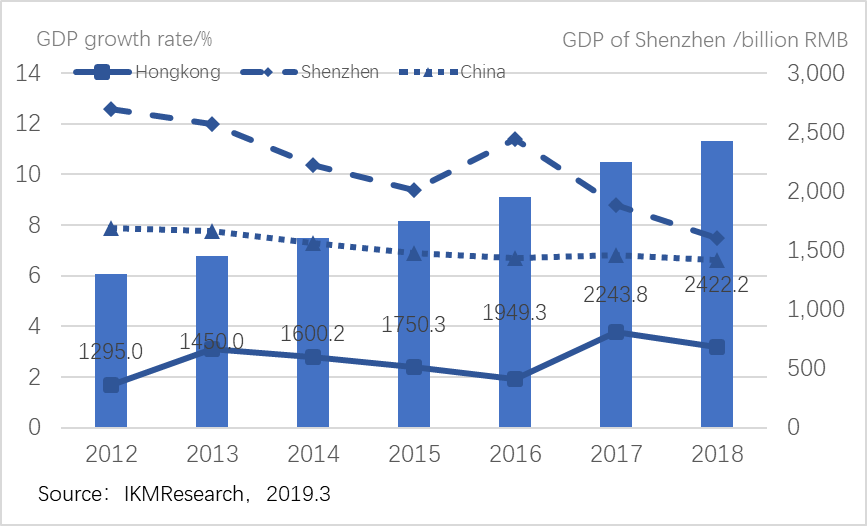

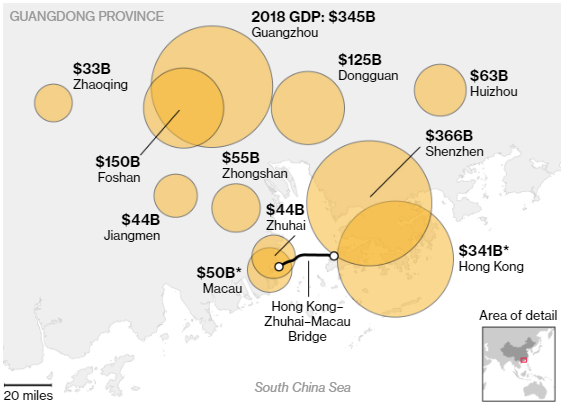

Huge Growth in GDP of ShenZhen

The southern Chinese city of Shenzhen (near by Hong Kong), Guangdong Province, was established as a Special Economic Zone (SEZ) less than 40 years ago. Between 1980 and 2016 Shenzhen’s GDP grew at an average annual rate of 22% and it stands at 2.4 trillion RMB in 2018, of which the economic size is among Asia’s top five cities. Shenzhen surpassed Hong Kong in GDP and became a global manufacturing powerhouse and evolving into a high-tech center of innovation.

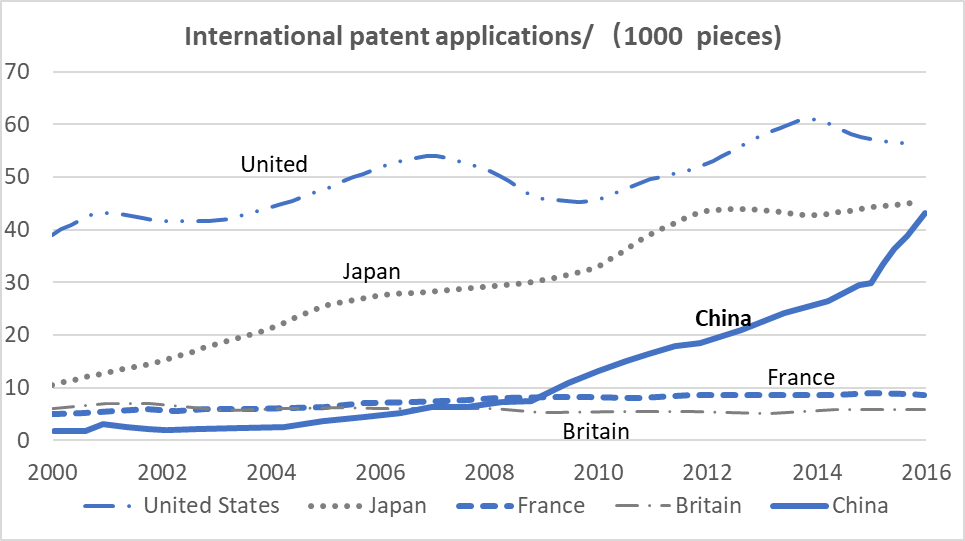

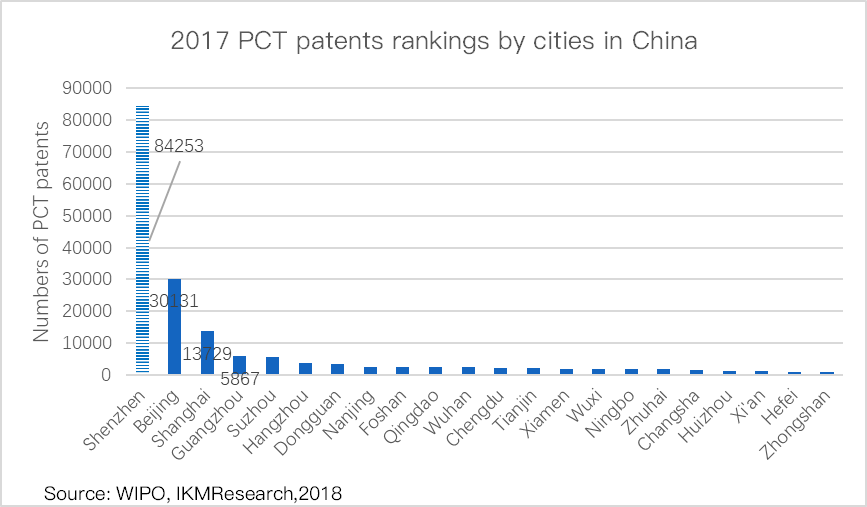

The world Top 3 patent applications Countries are United States, China and Japan. In 2018, U.S.-based applicants filed 56,142 PCT applications, followed by applicants from China (53,345) and Japan (49,702).

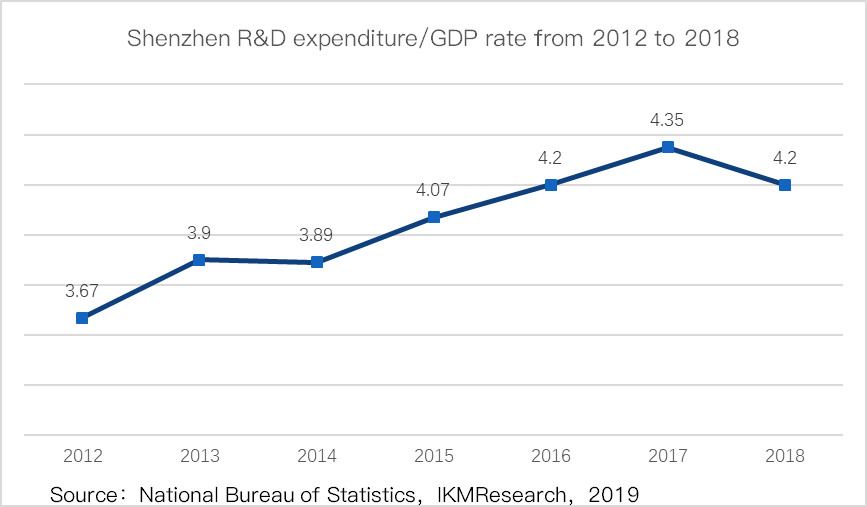

In 2018, Shenzhen’s R&D investment accounted for 4.2 percent of the city’s GDP, at a proportion which is equivalent to that of Israel.

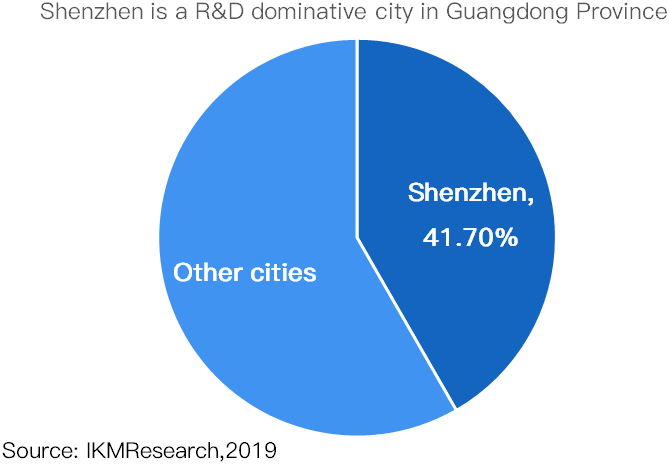

Shenzhen’s R&D expenditure input reached to 97.694 billion in 2017. The figure was 41.7% of the total of Guangdong Province and 5.5% of the total of China.

The city’s PCT patent applications have ranked first among China’s large and medium-sized cities for 15 years.

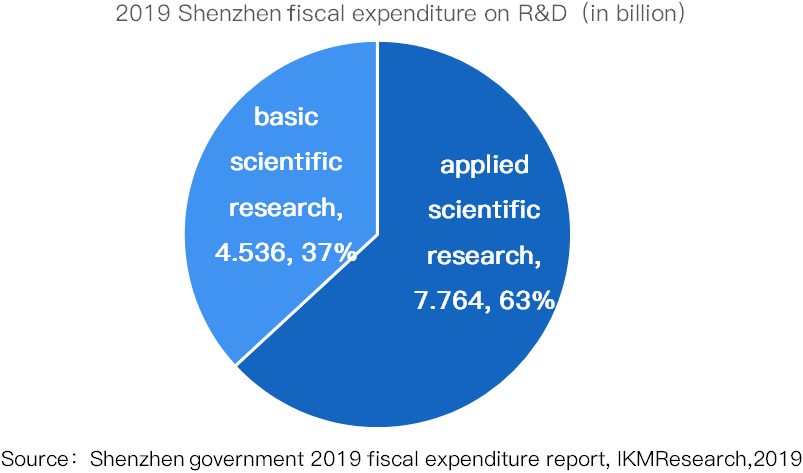

In 2019, Shenzhen’s R&D budget is 12.3 billion yuan, an increase of 8.41 billion yuan over five years ago, which is an increase of 500 percent. Shenzhen will also invest more than 4 billion yuan in basic scientific research this year, which is over one-third of the municipal government’s fiscal expenditure on scientific R&D.

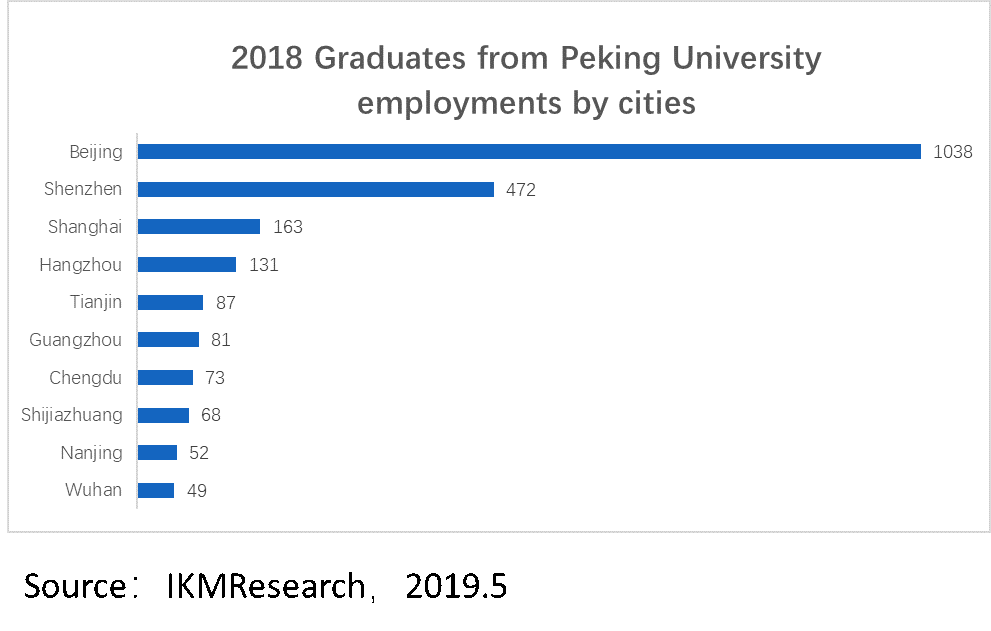

Shenzhen is one of the most brilliant attractive cities in China. More than 25% graduates from Peking University, top 2 universities in China which is located in Beijing, chose Shenzhen to develop their careers. Shenzhen is the second general choice.

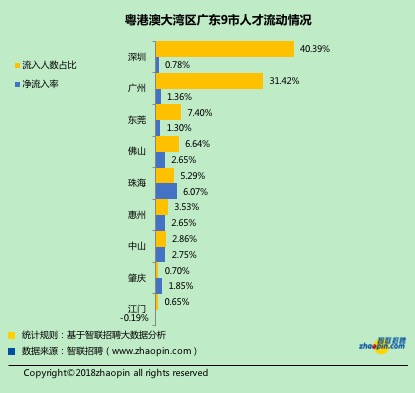

The talent inflow rate of Shenzhen is the highest among the Greater Bay Area.

At the same time, Shenzhen became an entrepreneur preferred city. Last year, the added value of emerging industries saw double-digit growth. The number of new high-tech enterprises has reached more than 3,000, and the total number of high-tech enterprises in the city has reached 144,000, ranking second in the country. Shenzhen has the world’s reputation in the innovation field.

However, Shenzhen is still in a shortage of senior talent. By the end of 2018, the total number of full-time academicians in Shenzhen was 41, and the total number of high-level talents was 12,611, which indicated a big gap between Shenzhen and cities like Beijing and Shanghai.

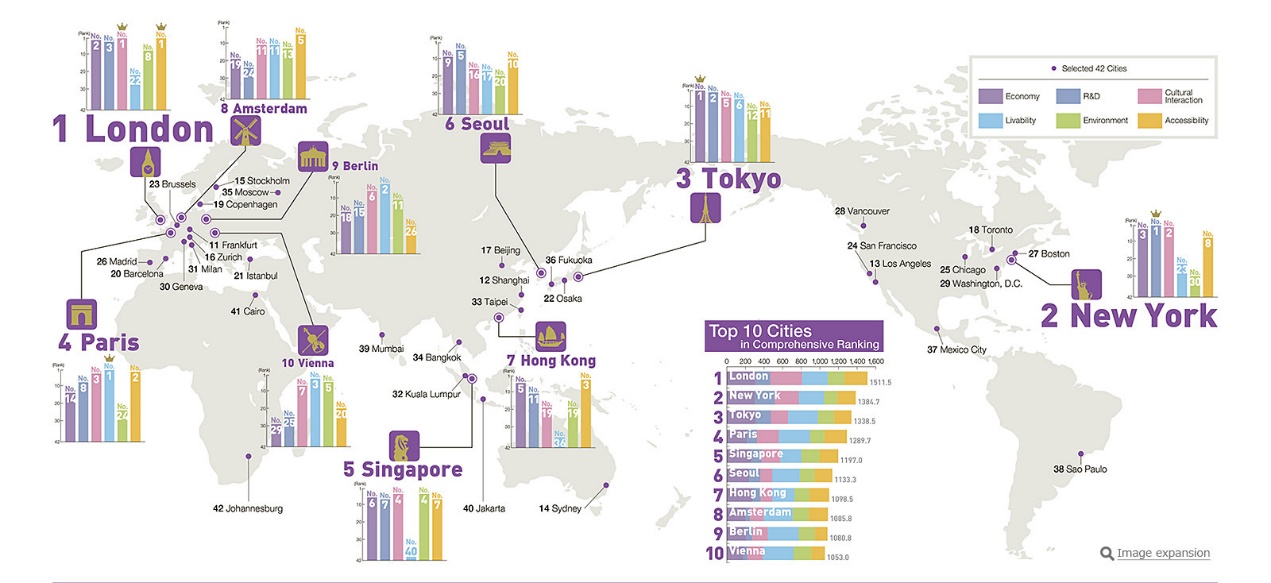

According to a survey released by a magazine under the Ministry of Science and Technology,Shenzhen ranks the 5th attractive cities to foreigners.

The subsidies for overseas high-end talents will help to leverage Shenzhen’s cities attraction.

Source: Global Power City Index (GPCI), Mori Memorial Foundation, IKMResearch,2018

For a long time, Hong Kong is generally subject to a lower tax rate than that in mainland China. Under the preferential policy, the individual incomes of overseas high-level science and technology talents will be taxed at 15 percent. For instance, talents with an annual salary of 1 million yuan (US$144,933) will only need to pay 150,000 yuan in income taxes, a reduction of 300,000 yuan compared with the sum taxed at the original rate. It is a great improvement for talents.

After the favorable tax landing, the Greater Bay Area will share a more equality environment and lure professionals to work for its high-tech region which links Hong Kong and Macau with cities in southern China.

Sources: Statistics Bureau of Guangdong Province, Census and Statistics Department Hong Kong, Macau Statistics and Census Bureau

*2017 data is most-recent available

The new policy would be executed from Jan. 1, 2019 to Dec. 31th, 2023. Talents will be exempted from paying part of individual income tax, according to the statement. The tax benefit is a positive tool to attract more experts to work in Shenzhen, while it’s still facing the uncertainty to be effective. Apart from the economic allowance, some invisible resources are also crucial factors, especially the education resource, the medical resource, the natural resource and the cultural environment. It remains to be a systematic challenge for the local government.