Mega office-space rental company WeWork is looking to raise $5 billion to $6 billion through the bond offering and is then looking to go public as soon as September. WeWork owner The We Company has tapped JPMorgan Chase & Co to head an upcoming debt offering, putting the bank in pole position to lead a planned initial public offering (IPO) later this year. Besides, Goldman Sachs is also expected to have prominent roles for the IPO.

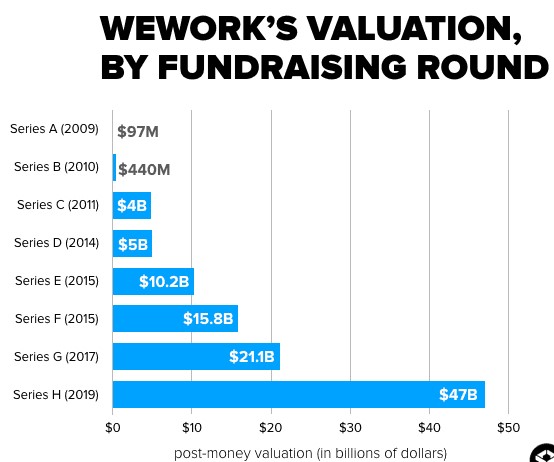

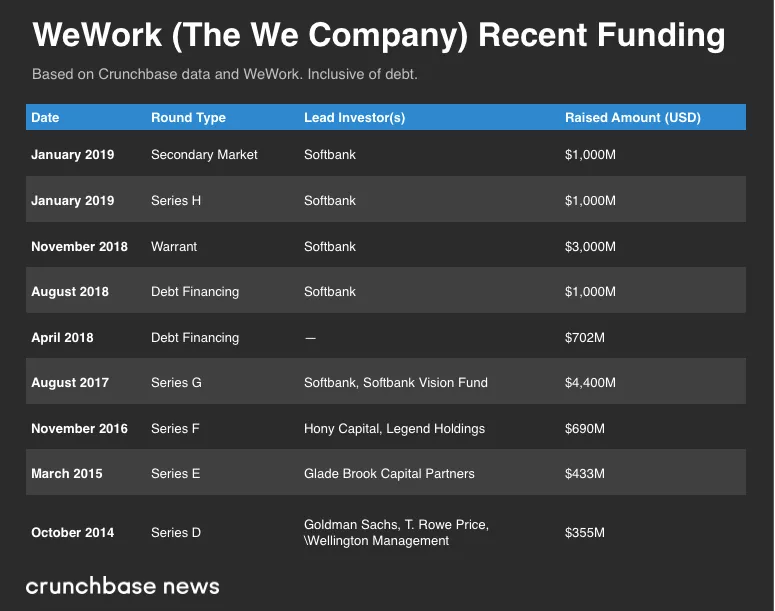

Since it was founded in 2011,WeWork has raised a total of $8.4 billion in a combination of debt and equity funding.

1.What is We Company (formerly WeWork)?

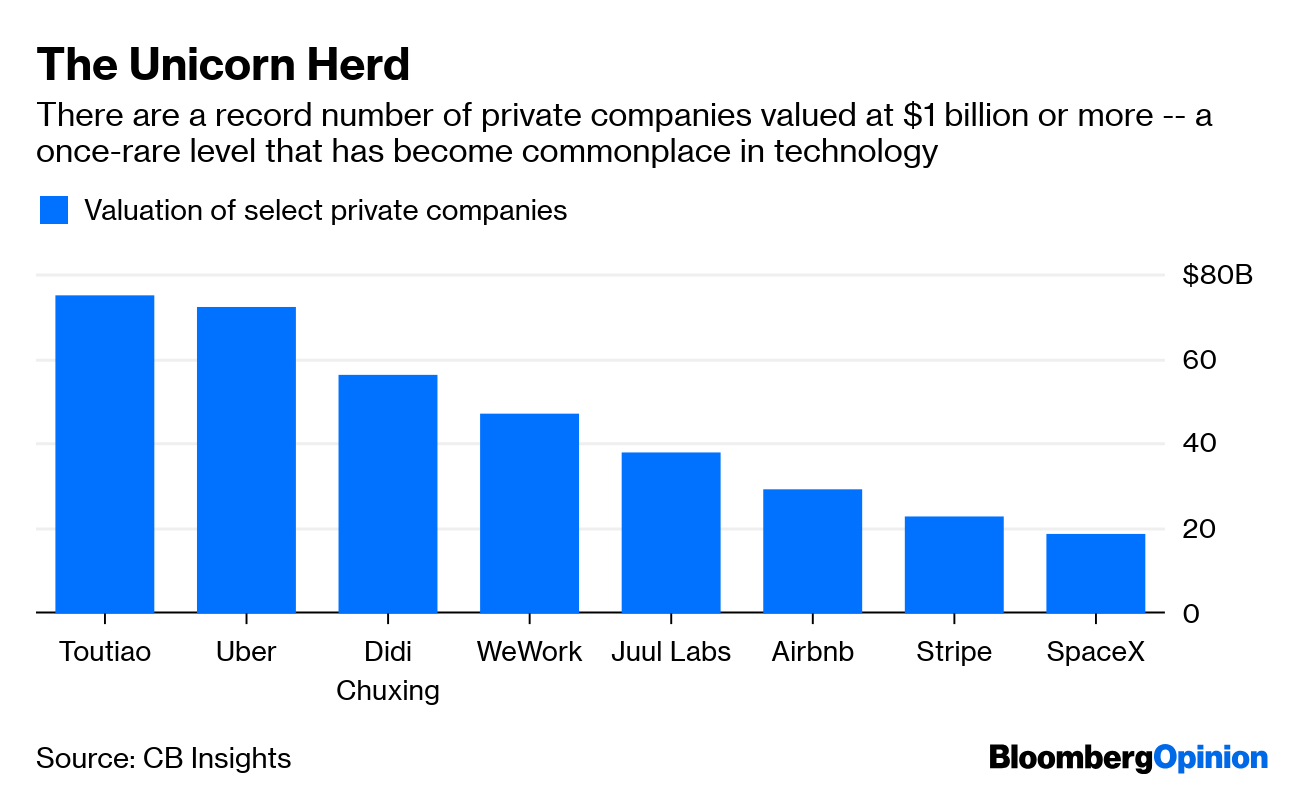

The We Company , better known as WeWork, is a well-known unicorn in silicon valley. The We Company has raised a total of $12.8B in funding over 14 rounds. Their latest funding was raised on Jan 9, 2019 from a Secondary Market round. SoftBank’s Son says WeWork is his ‘next Alibaba.

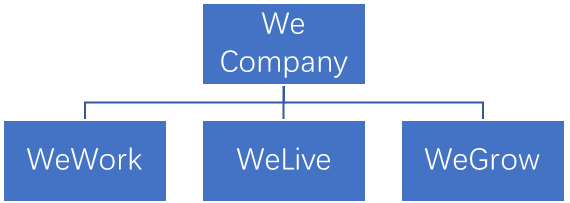

The We Company develops within three main branches: WeWork (for coworking office spaces), WeLive (for residential real estate and apartments), and WeGrow (its education arm).

WeWork provides shared workspaces for technology startup subculture communities, and services for entrepreneurs, freelancers, startups, small businesses and large enterprises. It designs and builds physical and virtual shared spaces and office services for entrepreneurs and companies.

WeWork is now in 425 locations and has over 400,000 members. Members, or the people who pay for monthly use of WeWork’s facilities, jumped to 401,000 from 186,000, accounting for 88 percent of revenue in 2018.The company established a 90% occupancy rate in 2018 as membership totals rose 116%, to 401,000.

WeLive is a new concept which promotes co-living spaces wherein people can reside in dorm-like apartments supplemented with different facilities like a private kitchen, large terrace, media room and much more. The tenants are given a chance to interact with one another during activities like daily happy hours, comedy nights and yoga classes.

WeLive is currently active in two cities—New York and Washington, D.C.—with one apartment building in each. In New York, the apartment units available are in the same building as shared office spaces, making the morning commute just an elevator ride.

WeGrow aims at 2-11 years old children and provides a seamless and positive application experience for prospective families. The school supporting the growth of children’s minds, bodies and souls through an integrated, differentiated curriculum rooted in the Montessori tradition. By placing equal emphasis on all 6 Pillars of Growth, children can continue to grow as balanced, realized, happy humans.

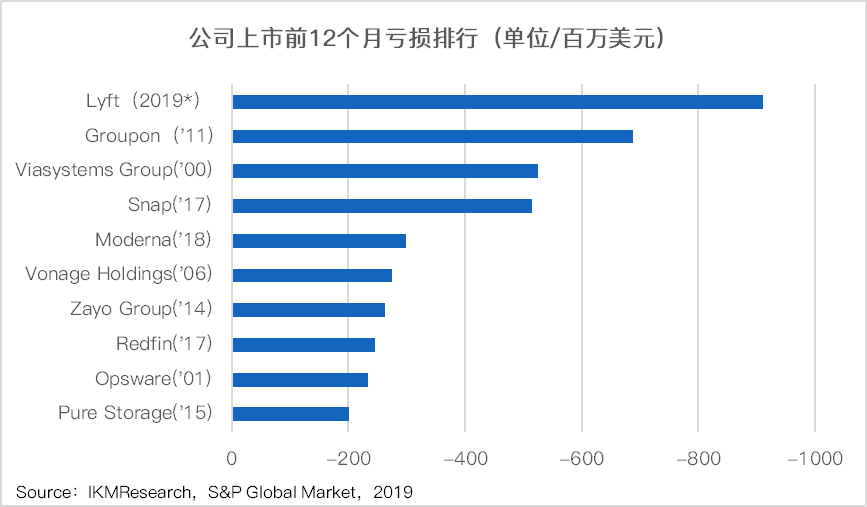

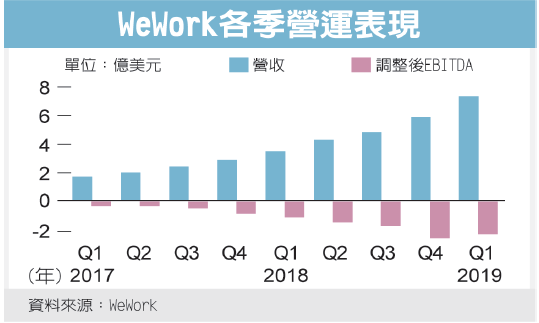

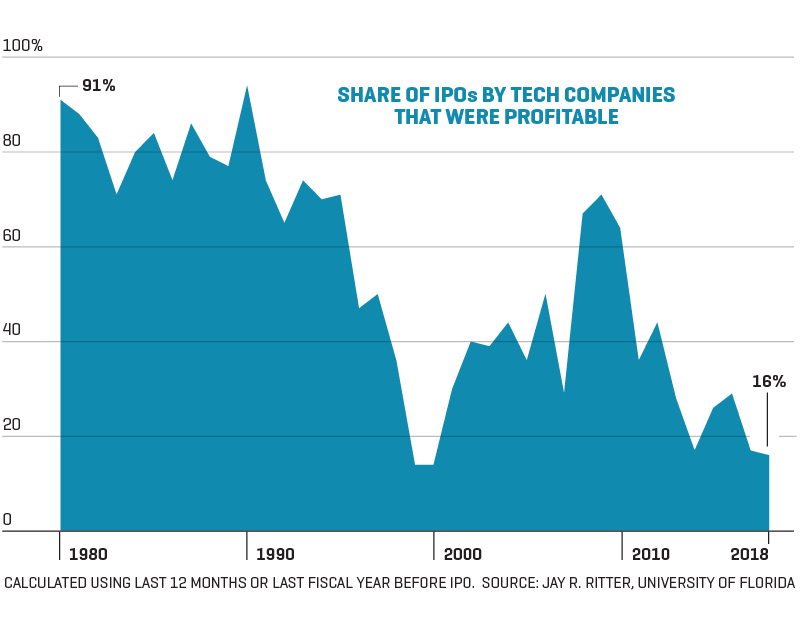

The company is hemorrhaging money: $219,000 every hour of every day during the 12 months leading up to March. it will need to convince investors that its significant growth makes it a worthwhile long-term investment despite equally large losses.

WeWork disclosed massive 2018 net losses of $1.9 billion in March on revenue of $1.8 billion,which was nearly twice as much as it in 2017(revenue of $933 million and the net losses of $ 886 million in 2017).

For the time being, membership to its coworking spaces is still generating the greatest revenue: $1.6 billion in revenue for 2018. A growing portion of revenues is coming from services: $84 million compared with $44.3 million in 2017. Its “other revenue” category, defined as “revenue associated with We Company Ventures businesses, which include PxWe, Meetup, Flatiron, Conductor, Creator Awards, and Strategic Events,” jumped from $19.6 million in 2017 to $128 million in 2018. And enterprise related revenues now comprise 32% of the company’s business.

Since launching eight years ago, the We Company has garnered 400,000 members in 100 cities across 27 countries.

WeWork’s occupancy rates have dropped: Its occupancy rate at the end of last year fell to about 80% from 84% in the third quarter, while another metric watched closely by WeWork–the average revenue each member creates per year–continued a gradual fall to $6,360. It is now down 13.5% from the start of 2016.

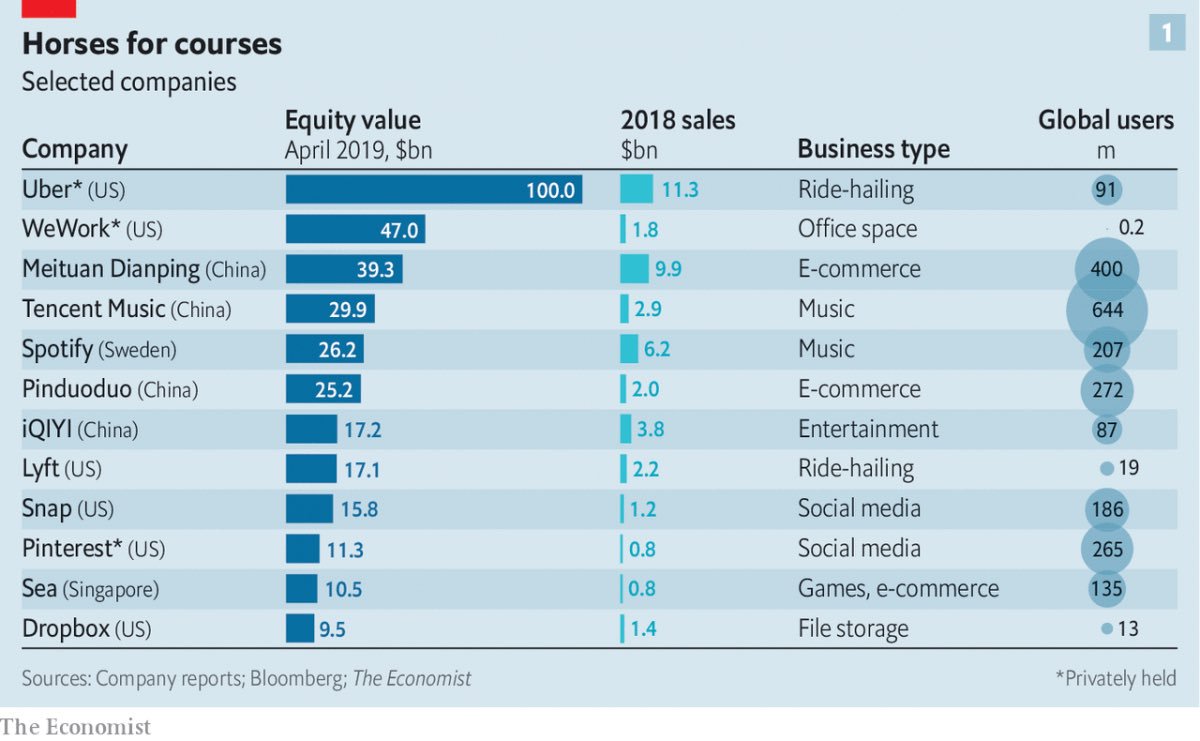

WeWork‘s IPO is poised to become the second largest offering of the year behind only Uber, which was valued at $82.4 billion following its May IPO on the New York Stock Exchange.

226 private companies are on the list waiting to go public in 2019. These companies represent a value of $697 billion. Assuming the companies float 15 percent of their value, you get over $100 billion in IPO offerings ($697 billion x 15 percent = $104.55 billion). IPOs could raise $100 billion this year, smashing through the records set in 1999 and 2000.

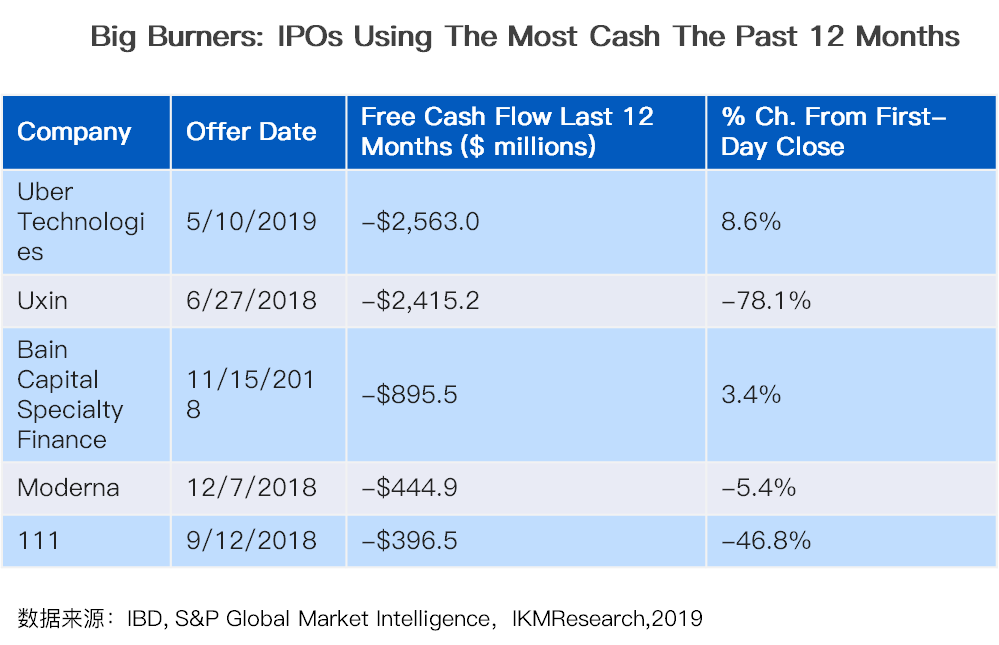

According to S&P Global Market Intelligence,68% of the 141 IPOs to start trading in the past 12 months that reported cash flow also burned cash. Uber consumed nearly $2 billion in cash from operations and another $597 million in capital expenditures the past 12 months. That totals free cash use of $2.6 billion the past 12 months. At that pace, the company would consume its $5.7 billion in cash and short-term investments in roughly two years.

Compared to the early days of the giants—Amazon, Apple, Facebook, and Google (now Alphabet), and you’ll see that they were models of frugality compared with the new wave.

So far, things have not gone to script. Lyft and Uber ’s IPOs have landed with a thud, complicating the path for other companies to go public. WeWork needs to emphasize a clear-cut path forward for investors to have confidence in the cash burning company.