Ping An HP got its second microlending license in China, which used to be difficult for foreign banks. Microlending has become a hot new area in internet financing, and although it’s far smaller than peer-to-peer(P2P) online lending.

What is microlending?

Microloans are small loans that are issued by individuals rather than banks or credit unions. Micro-lenders largely target small companies and low-income can be issued by a single individual or aggregated across several individuals who each contribute a portion of the total amount.

Why microlending is hot in China?

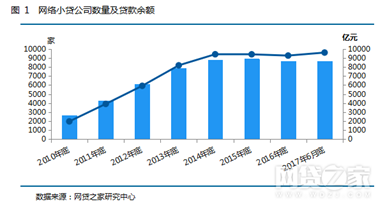

Microloans provide entrepreneurs an easier way to get financial support from the society. Entrepreneurs can get the urgent investments more quickly. For the meanwhile, above market interest rates of microloans also entice investors. Outstanding loans extended by China’s micro-credit companies amounted to 938 billion yuan ($144 billion) by the end of March, and the number of micro-credit companies in China came in at 886.However, the emerging risk is showing up for the low credit access, resulting the licenses distributions shrinking.

The new measures launched in March has eased licensing rules for foreign-owned banks on investment banking services, which were a clear signal that the regulator is granting more breathing room to foreign banks in the mainland, as they compete in a marketplace dominated by domestic lenders. The providers in China are used to be nonprofit financial institutions, microcredit companies, commercial banks, rural finance – VTBs, RCCs and PSBCs, P2P Lending and Alibaba.

Startups should be cautious about the microloans.

Microloans make the requirement of small loans more effective. But the market now stays immaturity, such as an unreasonable high rate. Startups should keep calm for the trick invisible.