Y Combinator unveil its new project of YC Bio

YC Bio is a new way to fund early-stage life science companies that are still in the lab phase. YC Bio will focus on healthspan and age-related disease at the first stage. The companies will go through the regular YC batch, but there will be a few differences.

YC Bio is the second vertical incubator of Y Combinator.

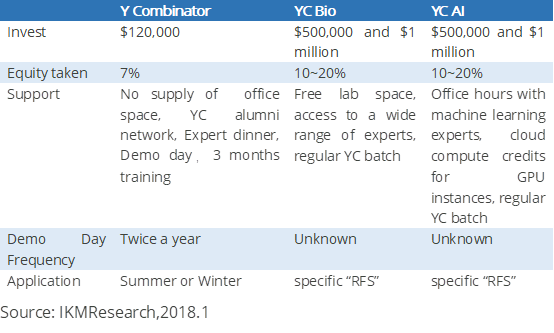

Instead of standard deal of YC (which is $120,000 invested for 7 percent ownership), YC will offer the biotech companies between $500,000 and $1 million for 10 to 20 percent ownership. Besides, Y Combinator launched its first” vertical” track for AI startups in 2017. The vertical incubators hatch the startups in a different way. They can get more related resource in Y Combinator. Startups in other biotech are of course welcome to apply for the standard YC program.

The incubation model of Y Combinator evolves.

Y Combinator has been regarded as one of the most successful incubators in the world. It provides a powerful network of influential YC mentors and alumni. Reddit, Dropbox, Airbnb, Quora and other companies that were hatched in Y Combinator buildup and strengthen its alumni system.

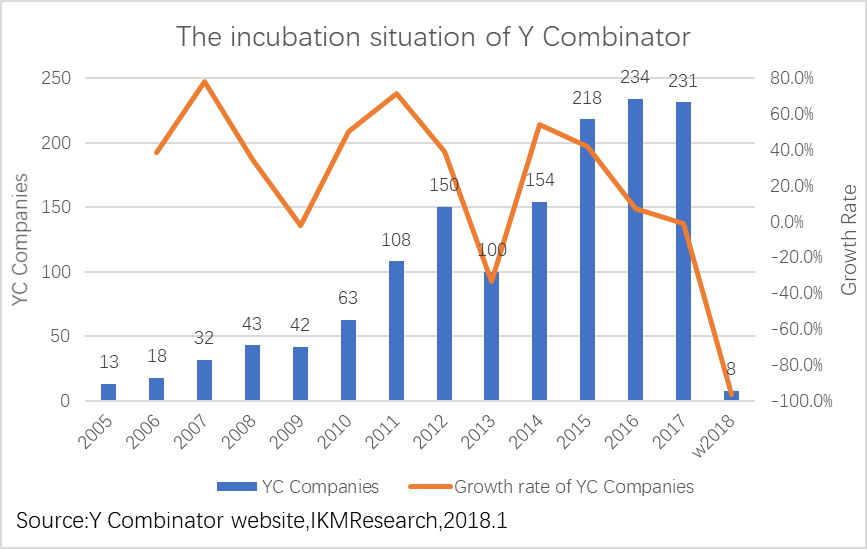

Found in 2005, Y Combinator has funded over 1,464 startups in summer and winter. With the development of Y Combinator, more and more promising startups are flourished. In 2016, the number of YC company reached the highest peak in history at 234 companies.

The core competence of Y Combinator

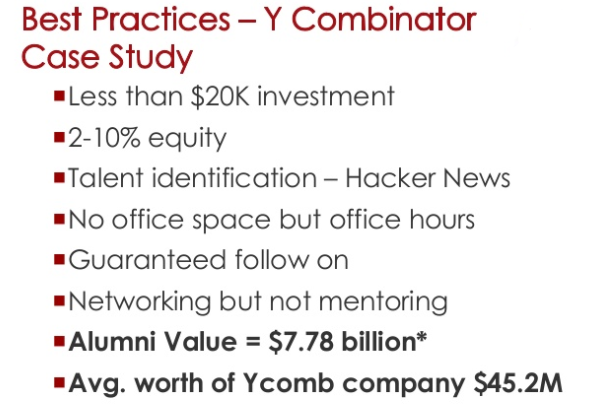

The effective communication system with the mentor composed one of the core competence of Y Combinator. Startups can make a reservation with the mentors to discuss the business development by a online booking system. After lots of practice, Y Combinator set up a number of strategies including portfolio filter, interview procedure, the best practices case studying, the cost minimum diligence to enhance the success rate.

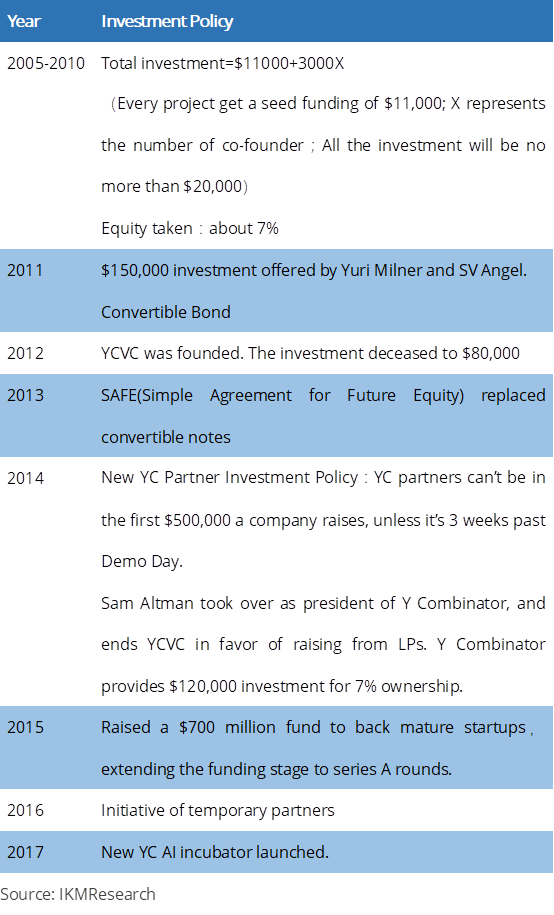

Y Combinator still adjust the incubation model.

The incubation model evolves gradually in the investment. Y Combinator has change a series of investment policy during these year.

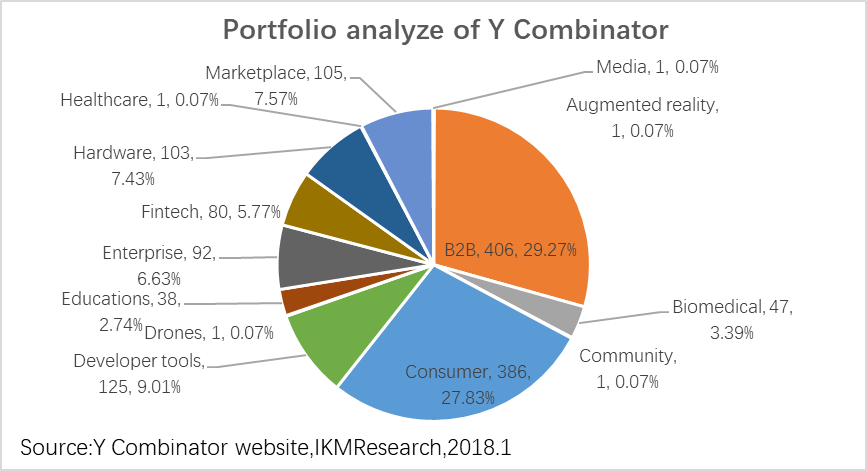

The area distribution of Y combinator Portfolio

Since 2005,Y Combinator have funded over 1464 startups. The sector of these companies covers 12 areas, including augmented reality, B2B, biomedical, community, consumer, developer tools, drones, educations, enterprise, fintech, hardware, healthcare, marketplace and media.

Y Combinator hatches the most number of startups in B2B area, consumer area and developer tools area. Incubation of media, augmented reality, community and drones’ area are new in the 2018 plan. Y Combinator incubated 21 biomedical companies in 2015, which ranks the first place in the number of startups by year.

The area of healthspan is different from traditional health life.

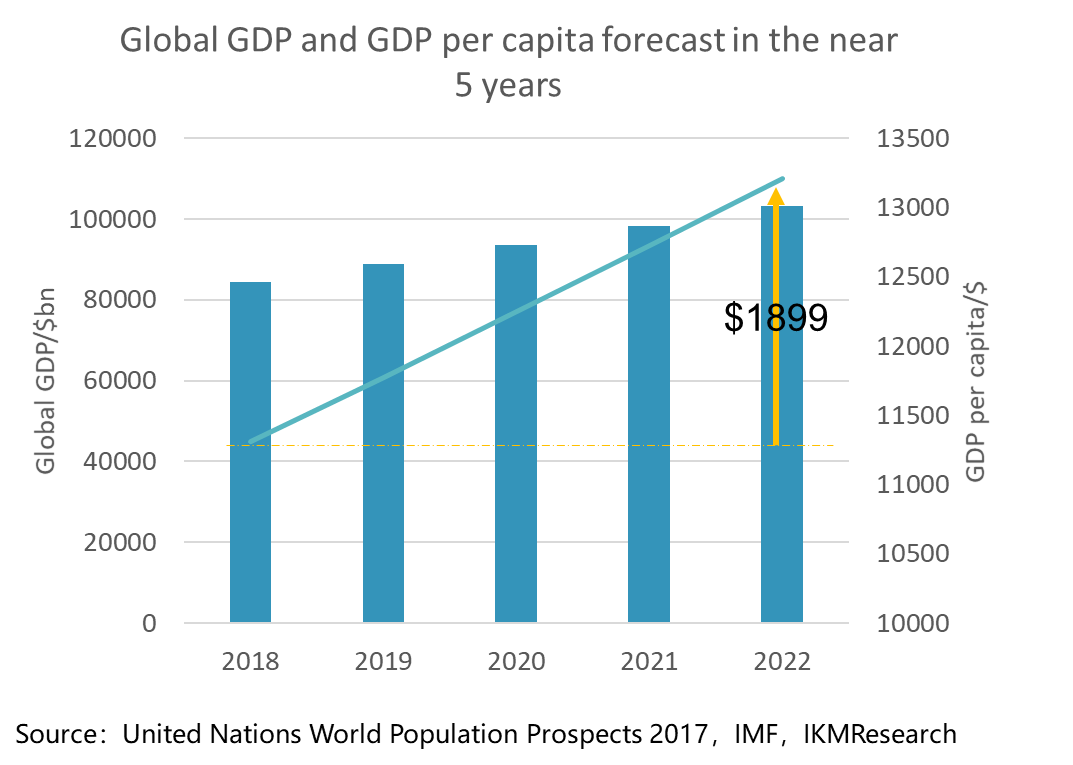

Healthspan works on the amount of time that someone is healthy,instead of the amount of time that they’re alive and potentially in bad health. With the development of economy, people have raised their demand of the life’s quality. Health span area is not completely about curing the disease, but also about the supplements.

The signals beneath the new incubator are about the vertical incubator and lower price of biotech development.

As we can see, one of the top incubator in the world are trying to change its incubation way by the new supplements of vertical incubators such as “YC Bio” and “YC AI”. Y Combinator used to be a comprehensive incubator in many areas. It has hatched many unicorns such as Airbnb, Quora, Reddit, Dropbox etc. The combined valuation is over $80B.

However, it’s exploring to expand its incubation methods and setting up different types of incubator. With the invade of sharing office providers such as WeWork, the incubators should change their minds on the incubation way.

Sencondly, there will be a revolution related to the biotech coming very soon. Y Combinator invested its first biotech company (Gingko Bioworks) in 2014. As the chart of biomedical portfolio, peak of activity began in 2015. But the incubations of biomedical companies do not exist in 2018.

The new YC Bio and the abundant storage of biotech may contribute to the decrease of biotech incubation. But the most important is that the investment of biotech is not regard as a good way.The investment of biotech is always to be huge and the risk of research and development is higher than other business.